Social Media Strategies for Financial Literacy: Turn Every Scroll into Financial Confidence

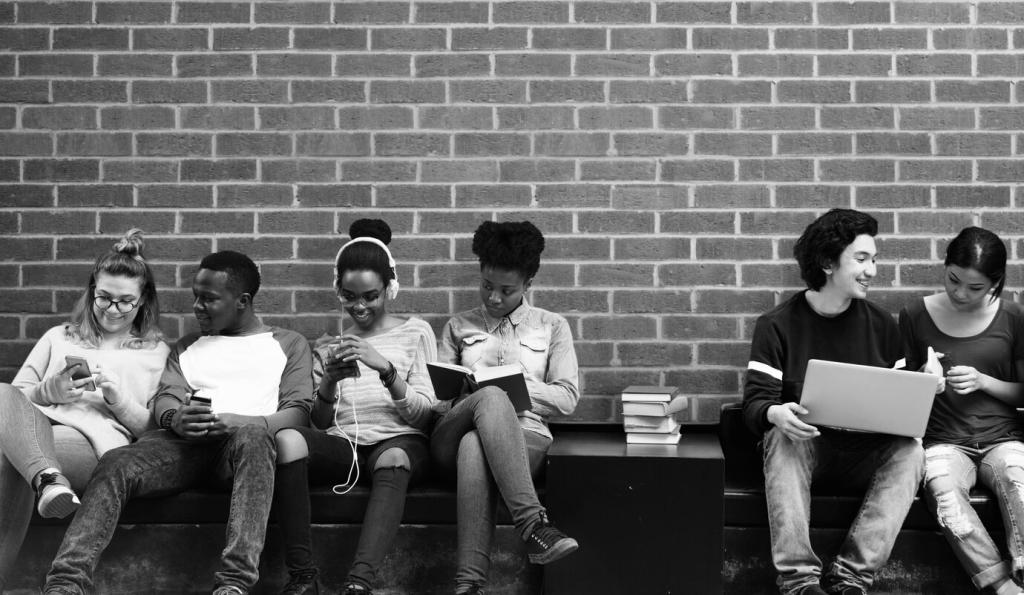

Chosen theme: Social Media Strategies for Financial Literacy. Welcome to a warm, practical hub where we transform timelines into teachable moments, empower everyday money decisions, and invite you to join a community that learns, shares, and grows together. Subscribe for fresh ideas and let’s make financial clarity go viral.

TikTok for Micro‑Lessons and Quick Wins

Use short, snappy videos to teach one concept at a time—like differentiating needs versus wants or setting a weekly saving trigger. Add captions, on‑screen prompts, and a repeatable hook so viewers instantly recognize your financial literacy series.

Instagram Carousels for Visual Frameworks

Carousels shine for step‑by‑step guidance—budget frameworks, debt ladder visuals, or credit score myths debunked panel by panel. Encourage shares by ending with a checklist slide and ask followers to save the post for their next money moment.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

This is the heading

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Trust, Accuracy, and Clear Boundaries

Cite Sources and Show Your Work

Link to reputable research, calculators, or official guidelines in captions and descriptions. Summarize the key takeaway in plain language, and invite questions. A transparent bibliography turns curiosity into confidence and reduces misinformation.

Define Education vs. Personalized Advice

Use a consistent disclaimer that content is general education, not individualized financial advice. Encourage viewers to consider personal circumstances or consult a professional. Clarity keeps the learning space safe, respectful, and sustainable.

Collaborate With Verified Educators

Co‑create posts with educators, nonprofit advocates, or counselors who have relevant credentials. Cross‑posting builds reach and deepens trust. Invite your audience to submit questions for experts to answer in live sessions or stitched responses.

Design Content That Triggers Action

01

End each post with a single, concrete action—set a savings rule, check your interest rate, or rename budget categories. Keep tasks tiny, time‑boxed, and trackable so completing them feels achievable and worth celebrating publicly.

02

Offer downloadable budgeting sheets, negotiation scripts, or spending trackers. Ask followers to comment a keyword to receive the resource link. Tools remove friction, making it easier for viewers to practice financial literacy in daily life.

03

Encourage weekly check‑ins where followers post their progress, wins, or questions. Feature success snapshots in stories and celebrate streaks. Visible momentum keeps community energy high and normalizes steady, incremental improvement.

Measure What Matters and Iterate

Learning KPIs Over Vanity Metrics

Track saves, comments with specific questions, completion rates, and repeat viewers. These signals indicate comprehension and curiosity. Pair them with short polls asking what clicked, what confused, and what topic should be explored next.

A/B Test Hooks, Formats, and Timing

Experiment with first‑line hooks, caption structures, and posting times to improve comprehension and retention. Compare carousel versus reel performance for the same lesson and keep a simple playbook documenting what resonates with your audience.

Feedback Loops With the Community

Invite followers to vote on next lessons, submit money myths to debunk, or share their budgeting frameworks. Publicly acknowledge contributions, then publish updated content that reflects community insight and real‑world use cases.

Inclusive, Accessible Financial Learning

01

Plain Language, No Jargon

Replace technical terms with everyday words and analogies. When a specialized term is necessary, define it immediately and give a short example. Clear language invites participation and reduces the intimidation that often surrounds money topics.

02

Accessible Formats and Visual Aids

Use captions, alt text, high‑contrast visuals, and descriptive audio. Infographics should emphasize simple shapes and consistent labels. Offer transcripts and downloadable summaries so people can learn at their own pace and revisit core ideas.

03

Culturally Aware Examples

Feature scenarios that reflect varied family structures, income patterns, and financial responsibilities. Encourage audience submissions to broaden representation. Respectful storytelling increases relevance and strengthens community trust and engagement.

Monthly Money Challenges

Host themed challenges—no‑spend weekends, subscription audits, or grocery budgeting. Provide daily prompts, checklists, and milestone shout‑outs. Ask participants to tag their progress so peers can encourage, swap tips, and celebrate practical wins.

Live Q&A and Office Hours

Schedule regular sessions to answer community questions, clarify misconceptions, and preview upcoming lessons. Pin key takeaways afterward so latecomers still benefit. Invite people to submit questions in advance to reduce anxiety and improve clarity.

Ambassadors and Peer Mentors

Invite active followers to host recap threads or walkthroughs using your templates. Recognize their contributions and share their best practices. Peer‑to‑peer explanation reinforces learning and helps new members feel welcome from day one.